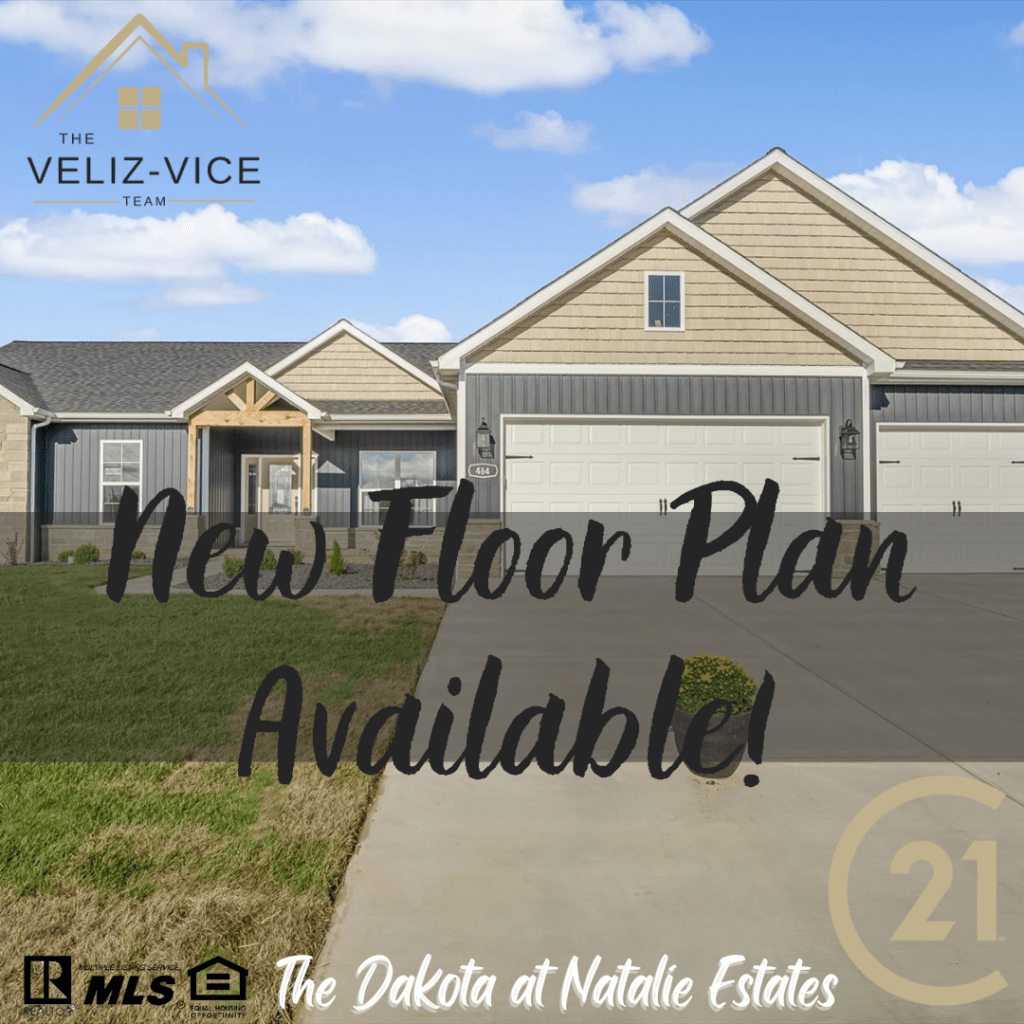

The Dakota floor plan by Quantum Homes, Inc., in Natalie Estates, Waterloo, IL

Discover the brilliance of Quantum Homes, Inc.’s latest creation – the Dakota floor plan. This modern marvel captures contemporary living while radiating a cozy ambiance. With over 2,000 square feet on one level, this plan is a testament to style and functionality.

Contemporary and Practical Design

Step inside the Dakota floor plan to experience its perfect blend of aesthetics and practicality. The layout keeps bedrooms private while enhancing overall flow. At its heart, the expansive great room features a captivating gas fireplace, ideal for snug gatherings.

Custom Kitchen and Flexibility

The custom kitchen with a spacious island merging seamlessly with a walk-in pantry and a breakfast dining area. The formal dining room can transform into a den or bedroom as per your wishes, adding flexibility to the design.

Master Retreat and Convenience

The master bedroom is a sanctuary, offering tranquility and space. The master bath boasts a tub and a separate shower, two vanities, and a water closet. A walk-in closet completes this luxurious space. Convenience is paramount, with a roomy main floor laundry and a closed staircase leading to an unfinished basement.

Turning Dreams into Reality

Quantum Homes, Inc. understands homes reflect lifestyles. Personalized home building consultations bring your vision to life. Ready to explore the Dakota floor plan in Natalie Estates, Waterloo, IL? Contact us to learn more about this exceptional design and begin your journey toward your dream home.

For details, visit The Dakota Floor Plan at Natalie Estates. Your dream home awaits.

Click here to visit the property website and watch the virtual tour of the new Dakota model home.